How much does it cost to buy an electric car?

The cutting-edge technology of an electric vehicle makes it a little more expensive upfront than a petrol or diesel one. However, the difference in cost has decreased markedly in the last decade and continues to fall as more EVs are sold. An electric vehicle will also make back any difference quickly with its dramatic running cost savings and road tax incentives.

But there are even more savings to be made. In Ireland, the Sustainable Energy Authority of Ireland (SEAI), are committed to getting more EVs on the road and, as of 2019, offers grants for all-electric vehicles and plug-in hybrids (PHEVs) to bring that price difference down further. ESB and Electric Ireland are also helping to facilitate electric driving by providing public charging options.

There are also rebates and discounts available from the Revenue Commissioners that take the upfront costs down as well as add to the savings you’ll make in the long run.

In fact, thanks to an SEAI grant and Vehicle Registration Tax relief, a new EV can now be purchased for as little as €25,999 on the road (OTR).

Buying an Electric Vehicle with SEAI Help

The SEAI will provide up to €5,000 towards the purchase of a new electric vehicle. You don’t even need to do anything to apply for it, just ask your dealer to apply on your behalf.

These grants are available for new vehicles that are listed at as little as €14,000 with a grant of €2,000 available in this category. There are currently no vehicles sold in Ireland in this price range, but it’s worth keeping an eye out for the more affordable up-and-coming models.

Vehicle Registration Tax Relief

As you probably know, registration of vehicle ownership in Ireland as subject to a VRT of between 14% and 36% of the sale value. Diesel vehicles have a 1% extra surcharge applied also. Vehicles are stratified by their greenhouse gas emissions so obviously electric and plug-in hybrid vehicles all fall into the lowest category.

But EVs are also entitled to a maximum rebate of €5,000 while plug-in hybrids are eligible for a maximum rebate of €2,500. These rebates are taken care of by your dealer, just like the SEAI grant.

The VRT relief scheme is guaranteed until 31st December 2019 when it is set for review.

Road Tax

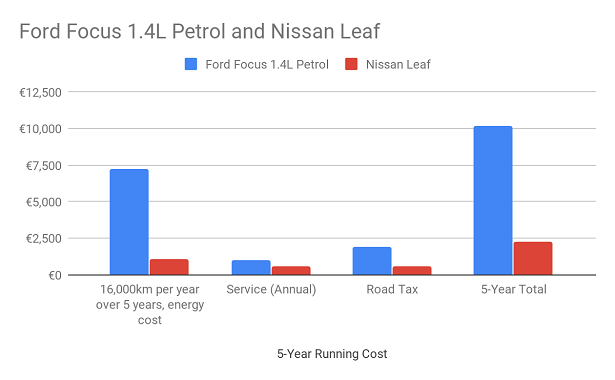

About ten years ago Irish road tax began to focus on exhaust emissions rather than engine size. Again, this places EVs and PHEVs in the lowest category with an annual tax of €120 - a tenner a month. For a petrol equivalent, like a Ford Focus, 1.4l the road tax would be €390 per annum.

Running Costs

EVs offer massive savings on fuel costs. Up to 80% is considered an accurate average figure for the amount saved but this can be higher if you do a lot of stop-start urban driving.

Figures from cartell.ie place the annual average mileage of the Irish motorist at around 16,000kms. To drive a Ford Focus 1.4L petrol that distance would cost €1,447* while driving an all-electric the same distance would cost €219 when charged at home using NightSaver rates. That’s a saving of €1,228 every single year with more saved the more you drive.

Servicing and Maintenance

Petrol and diesel vehicles are also more expensive to maintain due to their abundance of moving parts. It’s difficult to say just how much less it costs to keep an EV on the road in the long run but an annual service for a Nissan Leaf will set you back just €120, while that Ford Focus equivalent costs around €200.

Five Years of Savings

The cost of going electric has never been this low; generous grants and tax relief can help you get on the road and saving money at every turn.

Over the course of five years, you could be saving in excess of €6,000 in fuel alone along with €1,350 on Road Tax and around €400 on your annual vehicle servicing. So your electric car will continue saving you money, long after it’s repaid that extra up front cost.